Investment

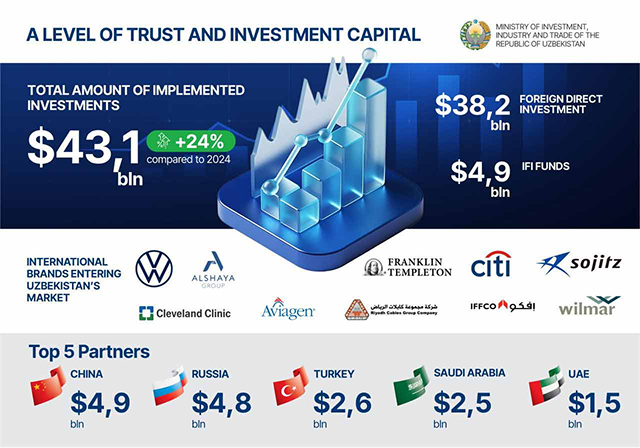

The Ministry of Investments, Industry and Trade of the Republic of Uzbekistan (MIIT) carries out comprehensive efforts to create a favorable environment for attracting investments, develop investment policy, support investment projects, and engage with foreign and domestic investors. The Ministry also actively promotes the country’s investment potential at international platforms by analyzing opportunities, providing support, and offering informational assistance to investors in key sectors of the economy.

Detailed official data on the volume and dynamics of investments in the economy of Uzbekistan are available on the portal of the Statistics Committee of the Republic of Uzbekistan.

To fully study the legal framework and apply it in practice, it is important to refer to the relevant sections of the national legal information system of the Republic of Uzbekistan, Lex.uz. This portal contains current laws, legal acts, and explanatory materials across key sectors, serving as an essential resource for investors and entrepreneurs to understand legal norms, plan financial activities, and establish international cooperation. Through these sections, one can access legal documents regulating banking activities, credit relations, investments, and foreign economic activities.